Who are Barclays?

Banking in the UK has changed massively over the last decade. From Metro Bank becoming the first high street bank to open its doors in over 100 years to digital-only start-ups - like Monzo and Starling - pushing new and innovative ways for customers to interact with their money. This has created a landscape in which big, traditional and established institutions, like Barclays, must evolve and adapt to survive.

Barclays, in particular, is one of the most digitally progressive of its traditional competitors. Their mobile app is forever winning "best in class" awards, and as a business, they are focused on continually improving their customers' products and experiences.

My role and responsibilities

As the project's sole designer, I worked with the product team and stakeholders, reporting to the Head of Design for this business area.

In addition to interface and experience design tasks, I played a crucial role in shaping the team's daily activities and content creation for the platform.

Opportunities and goals of the project

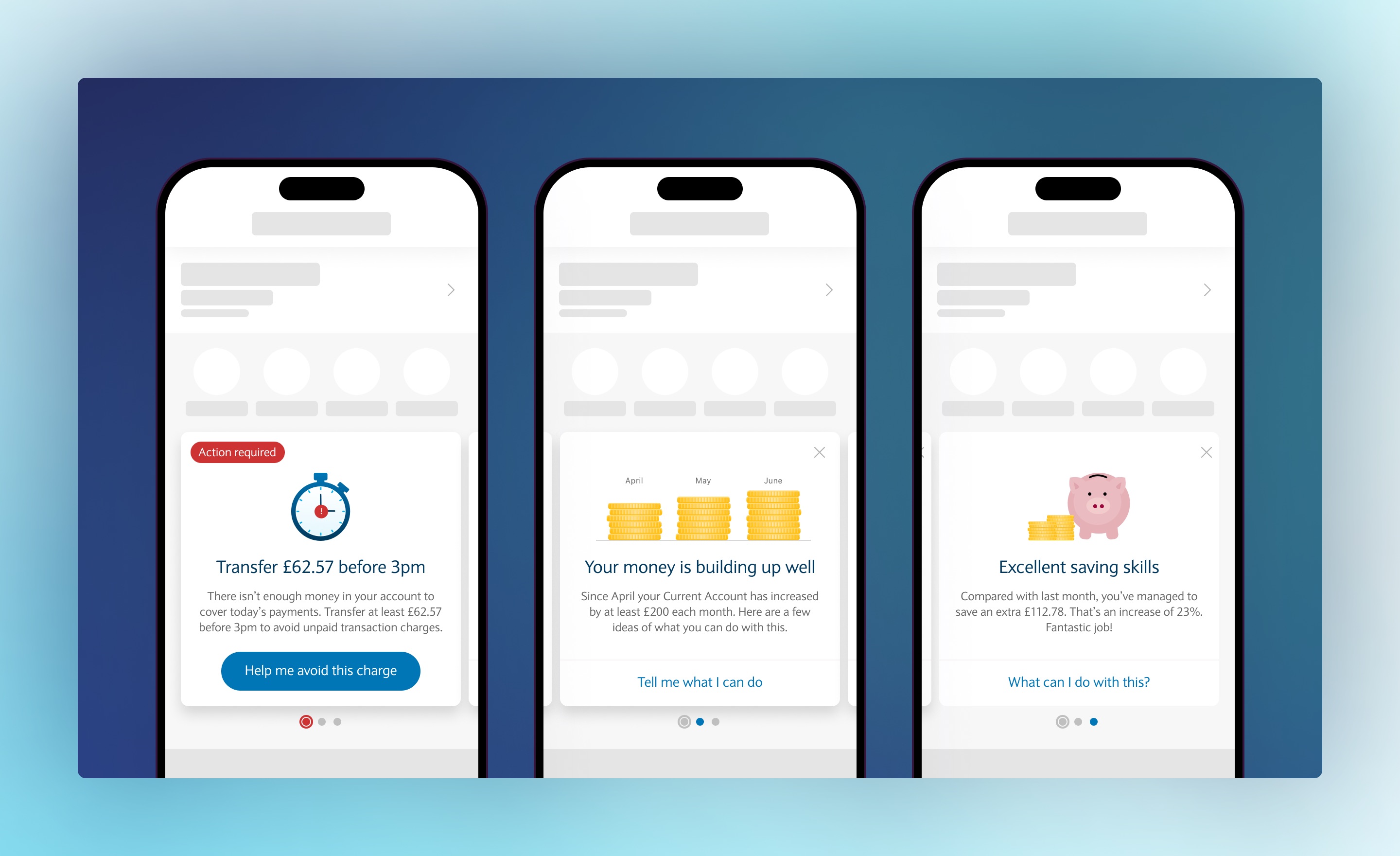

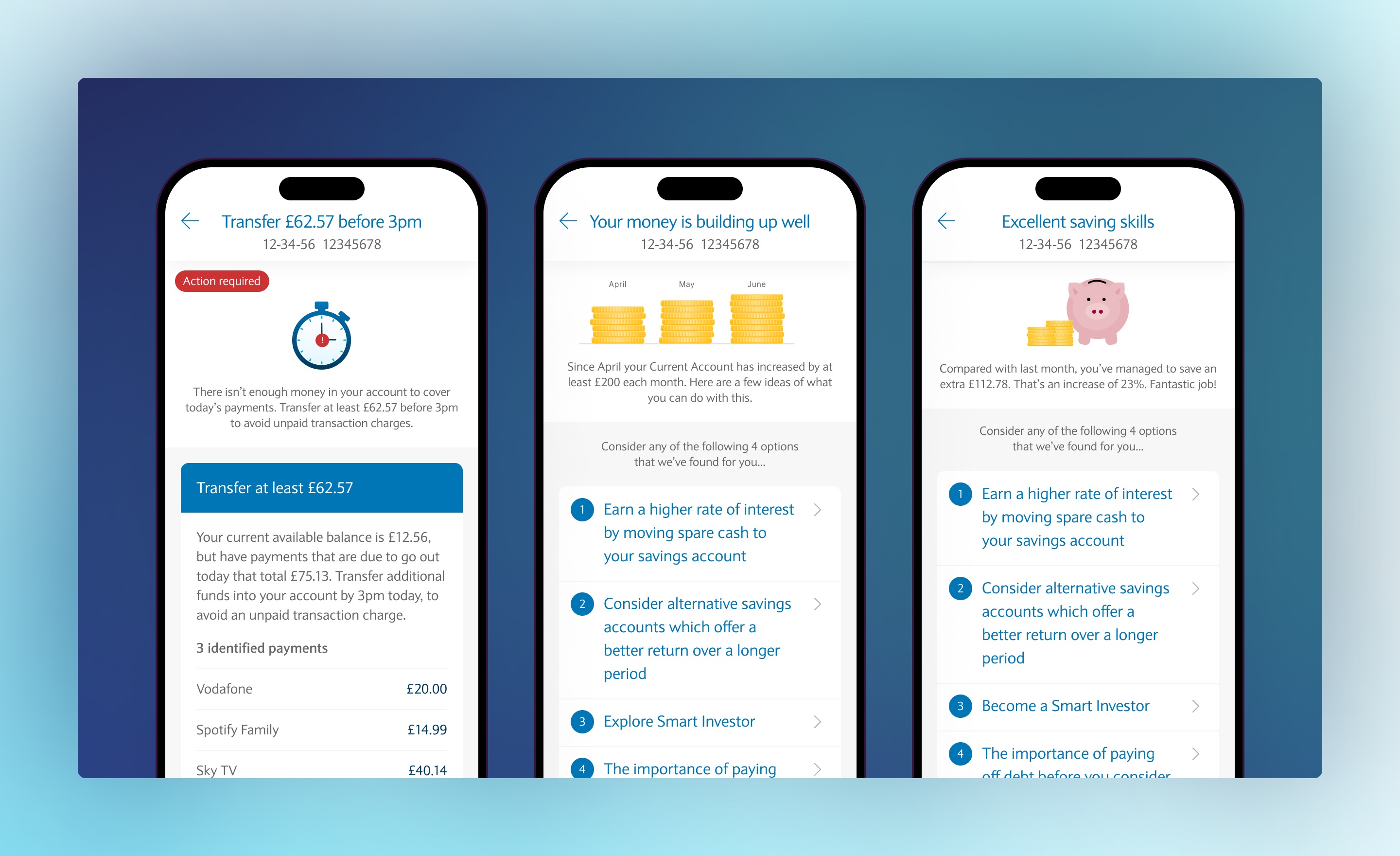

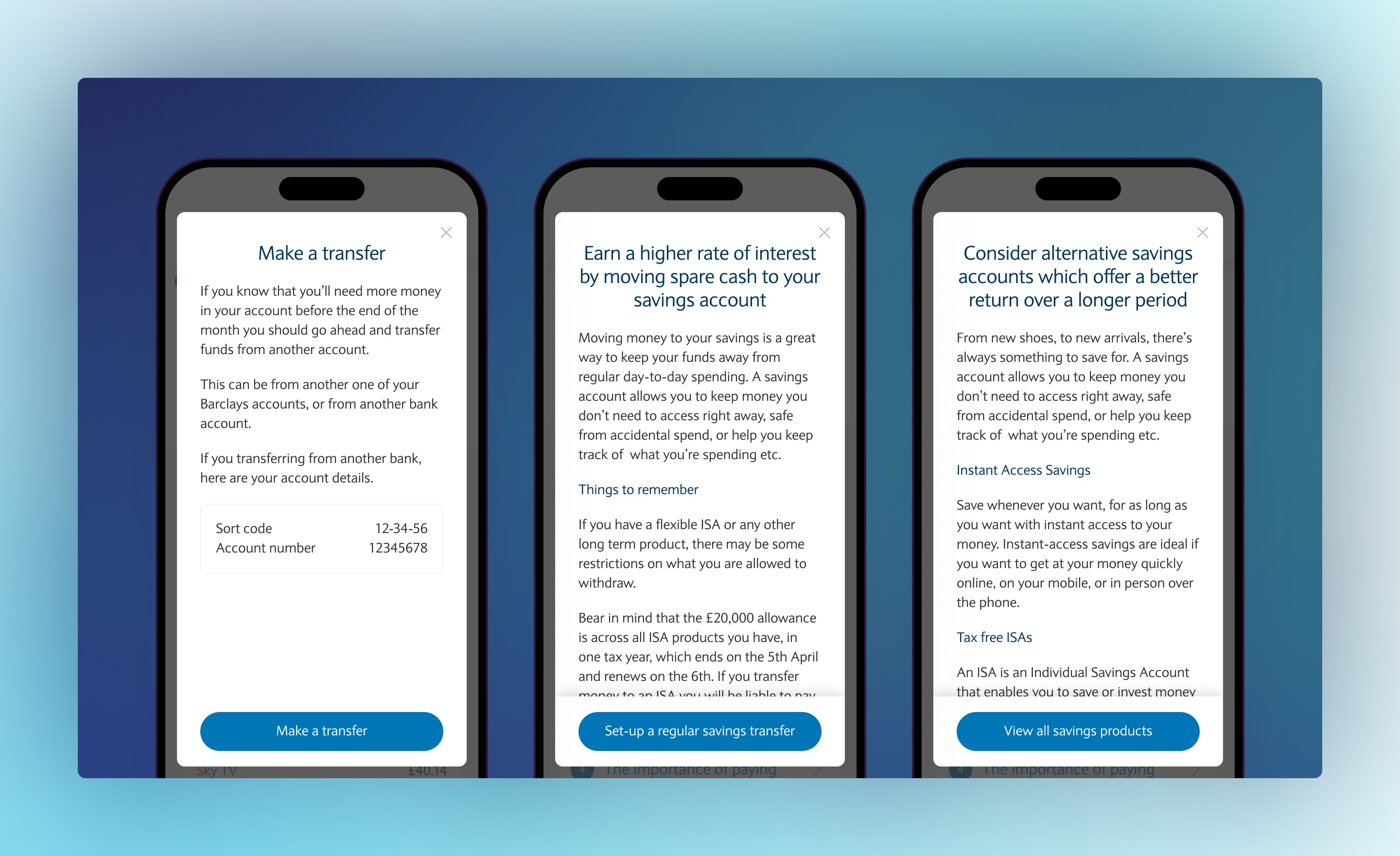

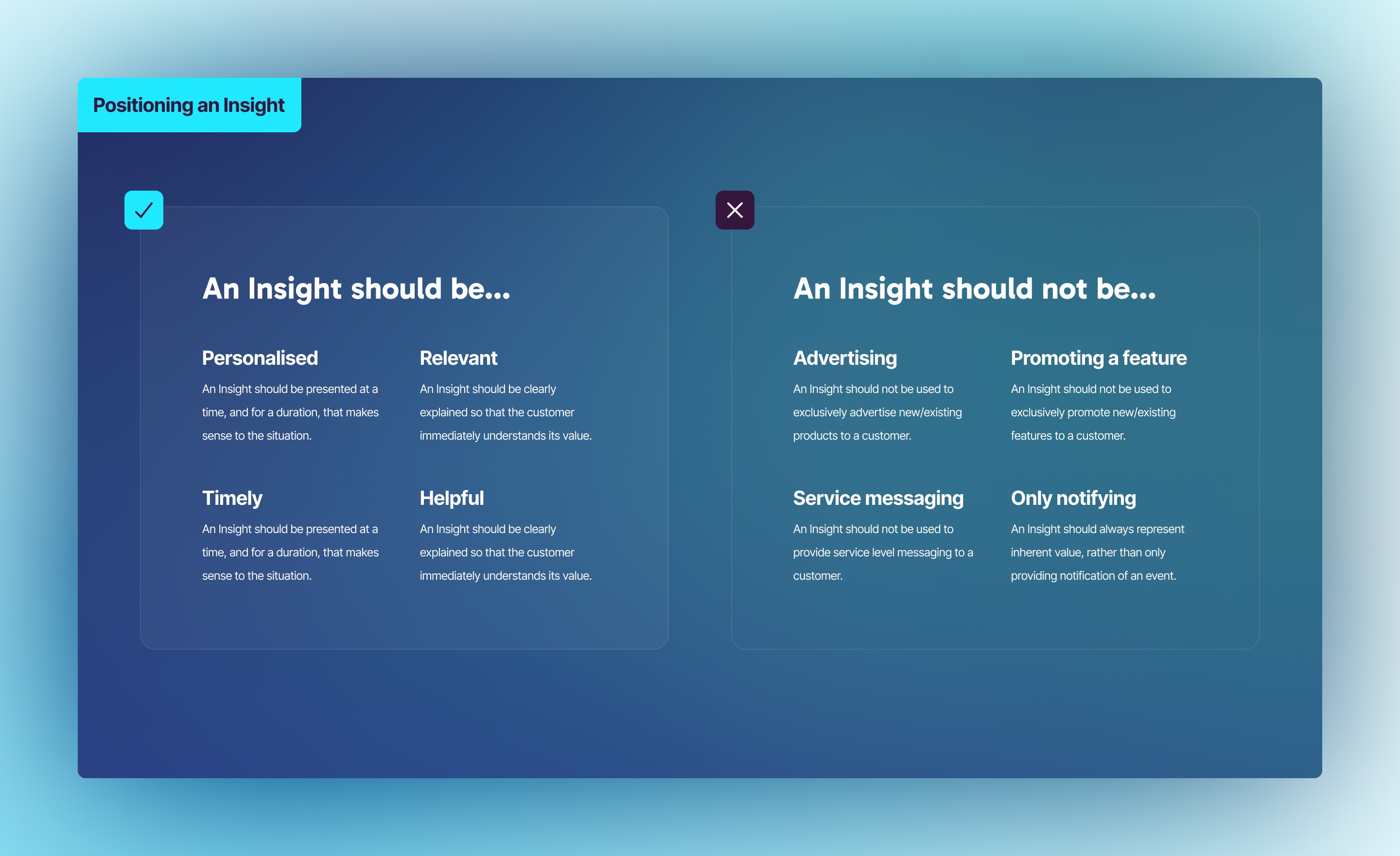

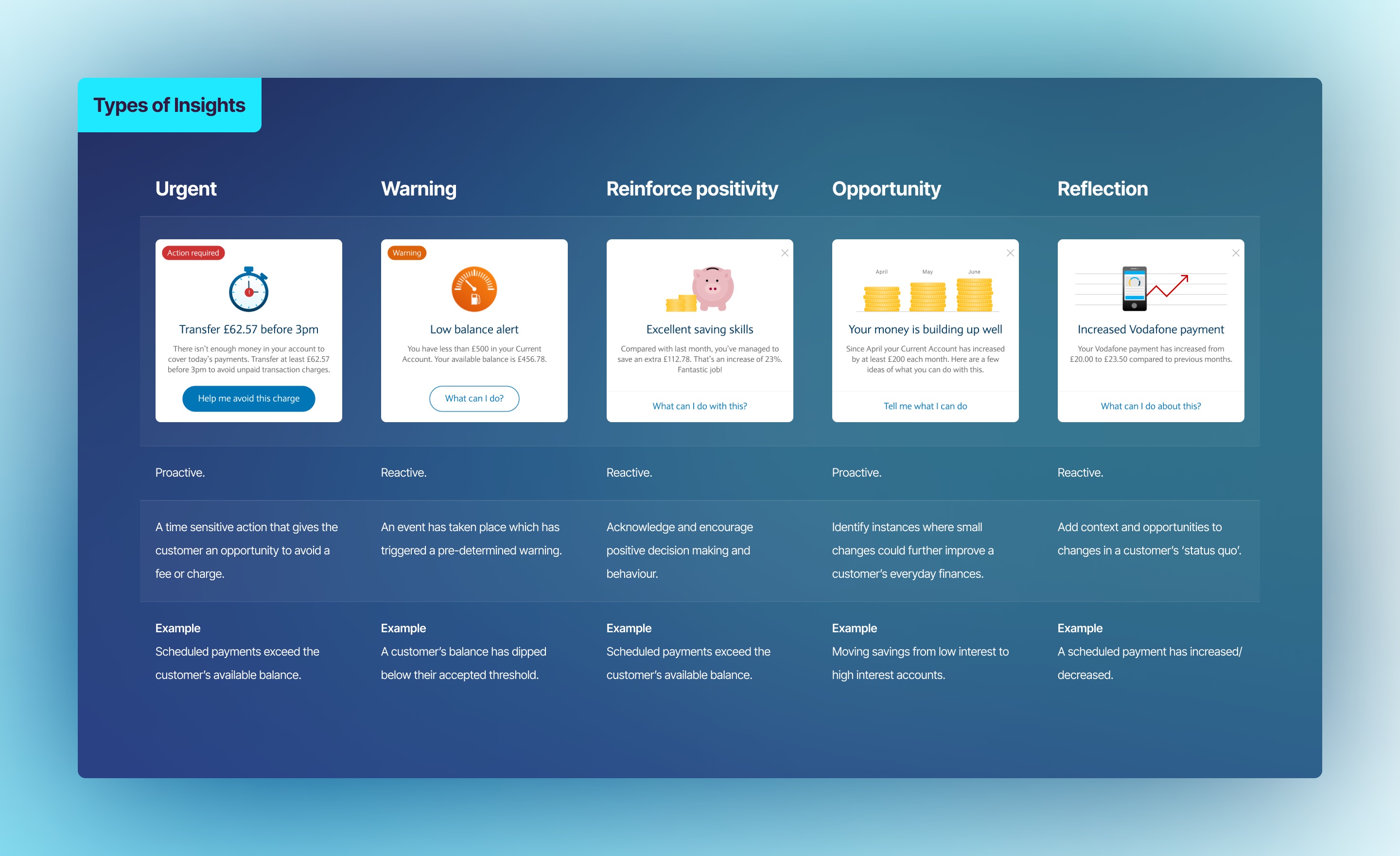

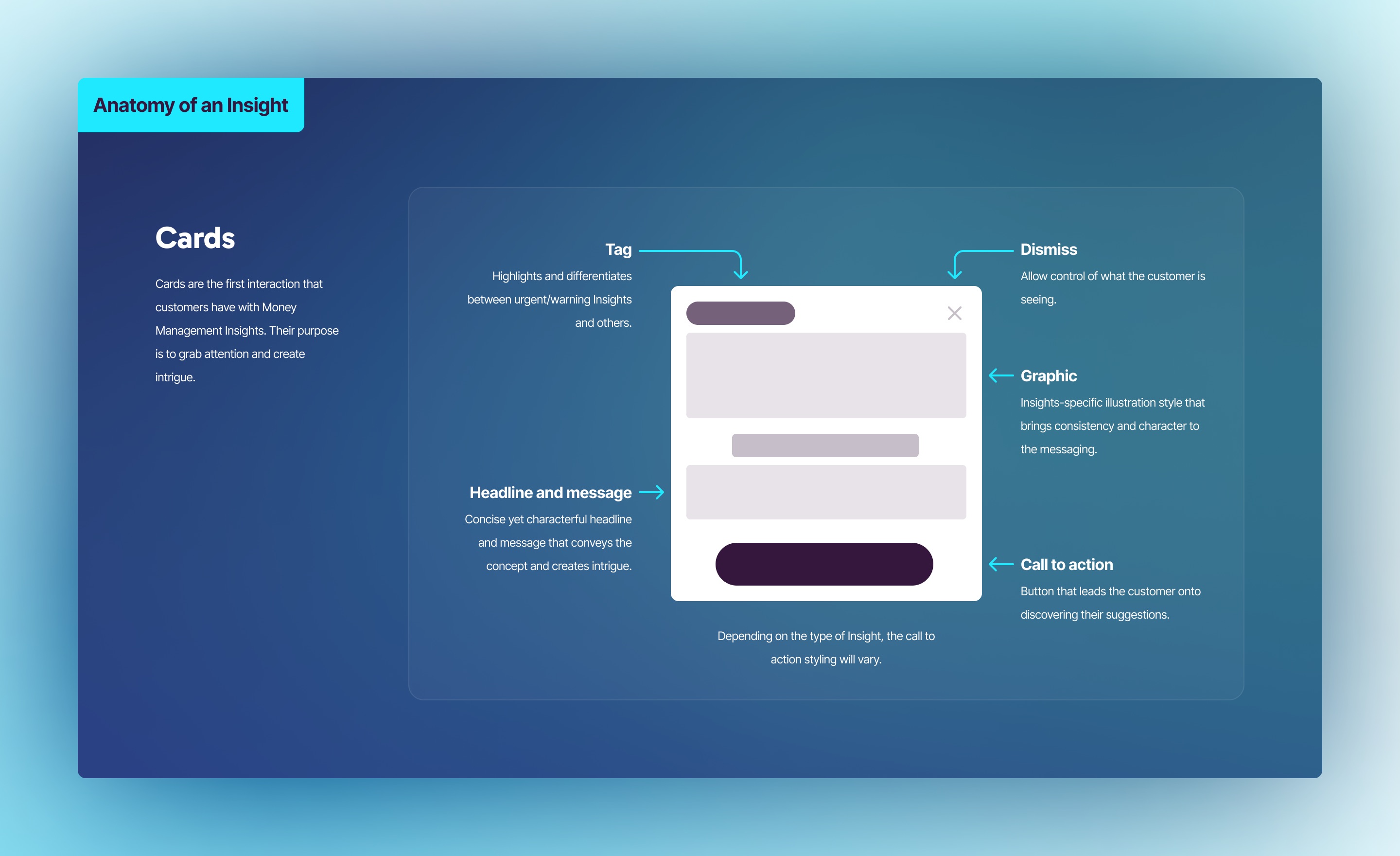

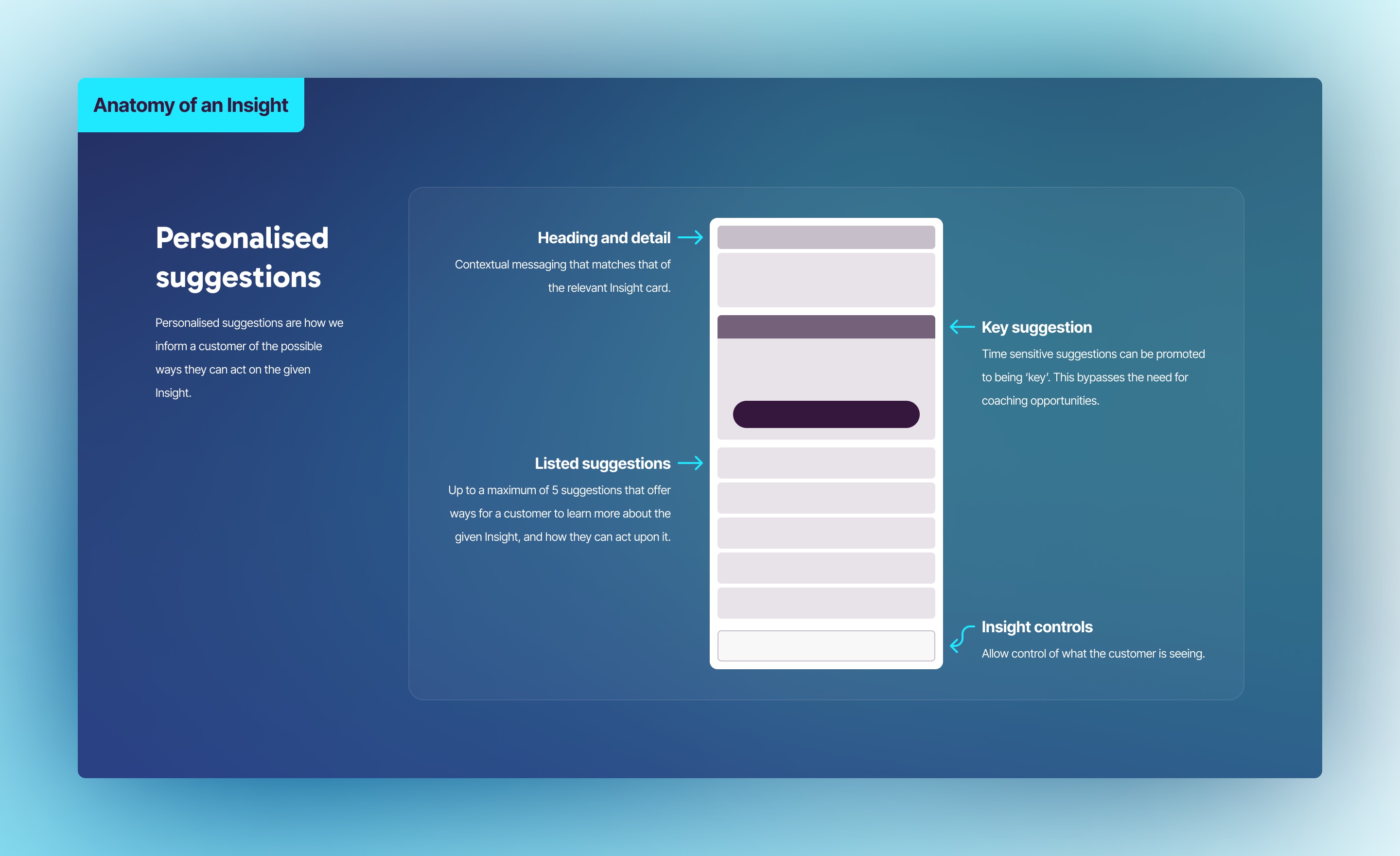

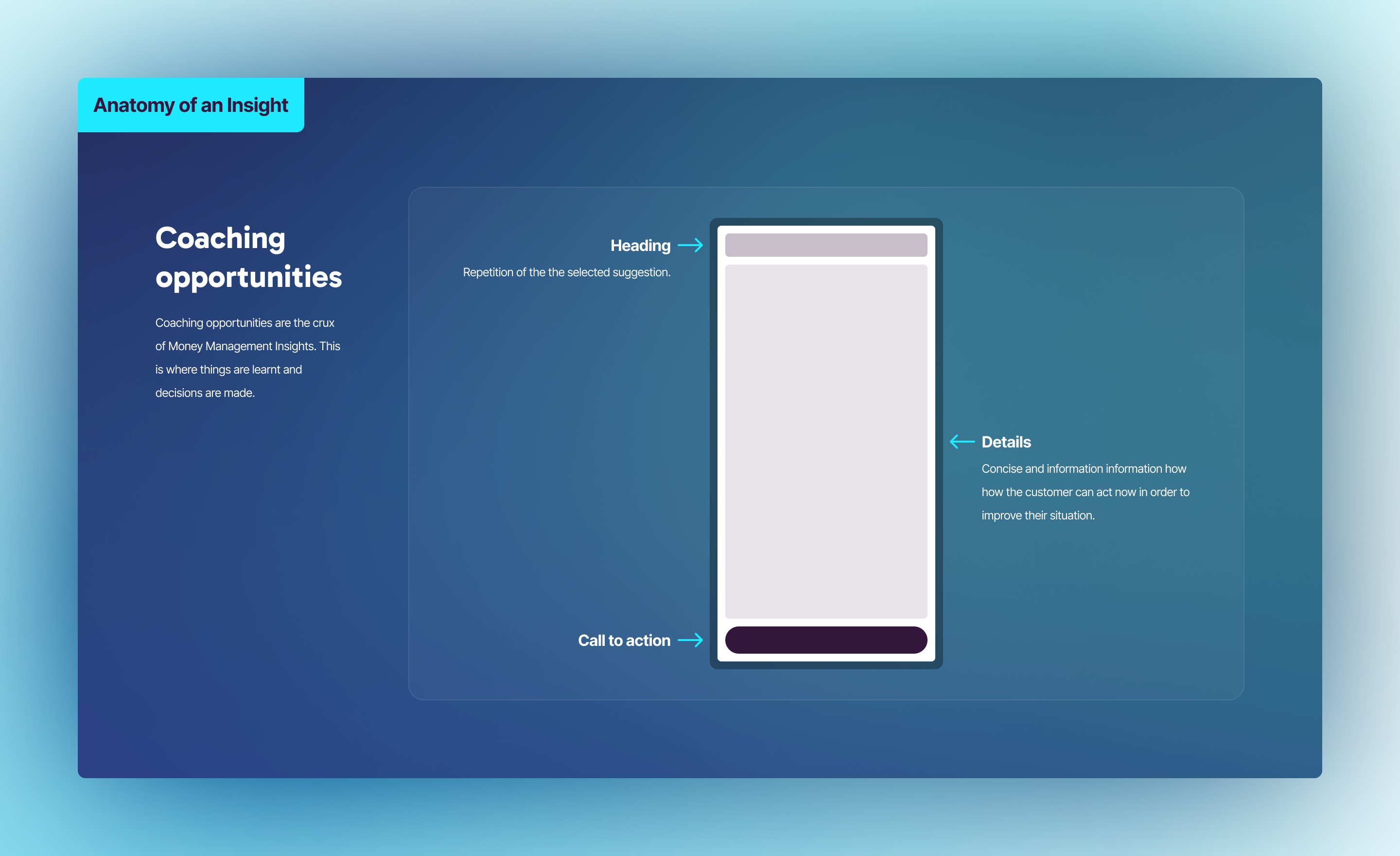

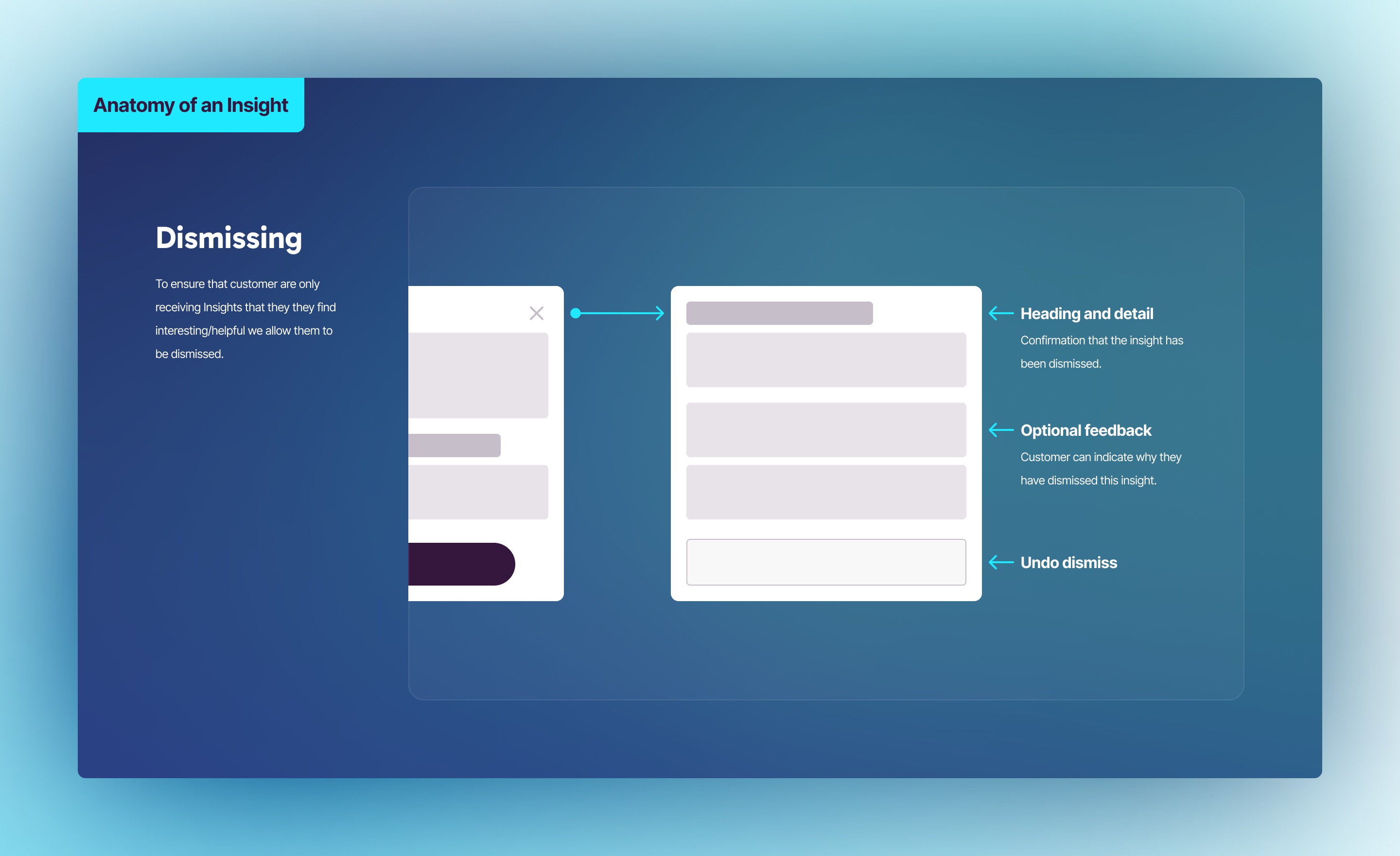

Money Management Insights is a platform that allows bespoke and personalised 'insightful' messages (and suggestions) to be delivered to customers at timely and relevant moments.

To identify customer pain points and opportunities, we connected with the sprinting Jobs to be Done Squads and Customer Segment Teams rather than approaching each product centre directly. This enabled us to focus on solving customer problems rather than selling financial products.

These problems were distilled into a list of common themes, which brought focus to workshops to discover possible solutions.

Biggest challenge faced

Our biggest challenge was developing a new feature for the industry and the bank without any existing reference points. Every step was a unique experience, and we often found ourselves heading in the wrong direction.

Each new business area we partnered with had reservations about moving forward. Doing new things is challenging, and they're supposed to be.

Overcoming that challenge

Sticking together.

Excuse the following cliché-fest, but without the trust, patience, and communication that each of the members of the Insights team possessed, I don't think I'd be talking about a live project which is being used by customers today.

This teamwork and shared vision meant we could stay focused on what we were trying to create, even when it felt like the world was falling apart.

The thing I most enjoyed

Barclays are no stranger to user testing. The digital team understands that it's an essential part of crafting the right solution. For this project, we ran numerous focus groups, devised a new way (to Barclays) of running lab testing, and continued to run ad-hoc guerilla testing sessions.

It's the lab testing that was most interesting, though. Because of the nature of Insights, they only make sense if you're in a specific financial situation or are displaying the behaviour the message is referencing. If they don't reflect your case, it's challenging for participants to empathise and steer us on how useful they might be.

So, working with our research partners, we devised a plan where we would run two interconnected sessions.

The first would take the form of an hour-long interview where the aim was to gain an understanding of how each participant interacts with their money.

- What products do they currently have?

- How do they use those products?

- How well do they feel they manage their money?

- If they were to have an emergency or unexpected expense for around £1,000, how might they fund it?

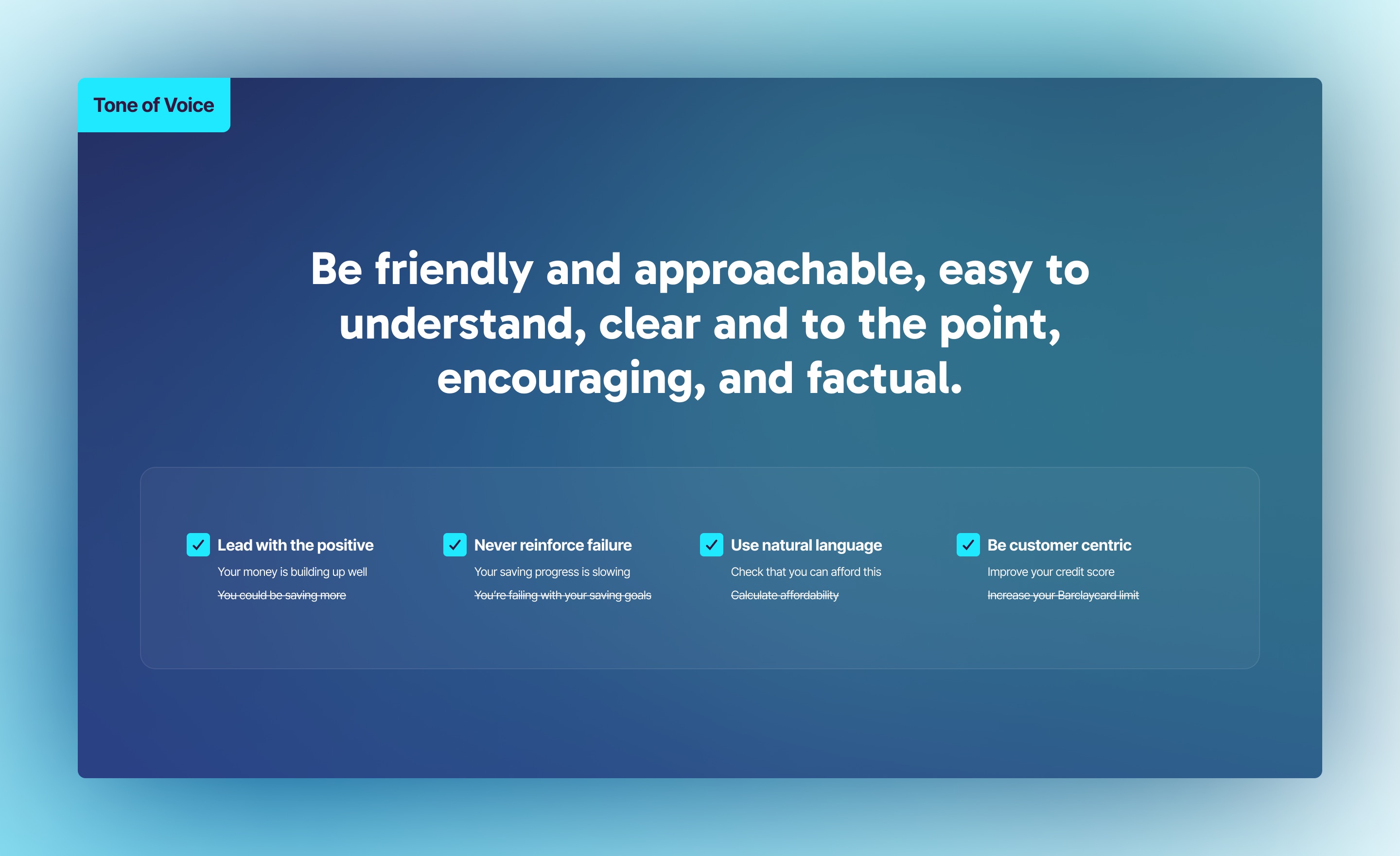

For the second session, we created a bespoke set of Insights for each participant that referenced their products, goals, and behaviour. This - for the first time - allowed us to observe genuine reactions to the feature and the individual Insights. The feedback was priceless and led to changes in how we wrote (and continually tested) Insights moving forward.

Outcome and learnings

As with most things, an idea can seem so simple. Insights were no different. The bank already had all of the data points that we'd need. It was just a case of triggering the delivery of a specific message to an individual customer when parameters were reached. Easy.

However, the ambition and complexity of this relatively simple-sounding act soon became apparent.

As you would expect with any large institution, systems that we would grow to rely on had yet to be designed with this level of real-time data retrieval and processing in mind, which meant a lot of exploration and workarounds.

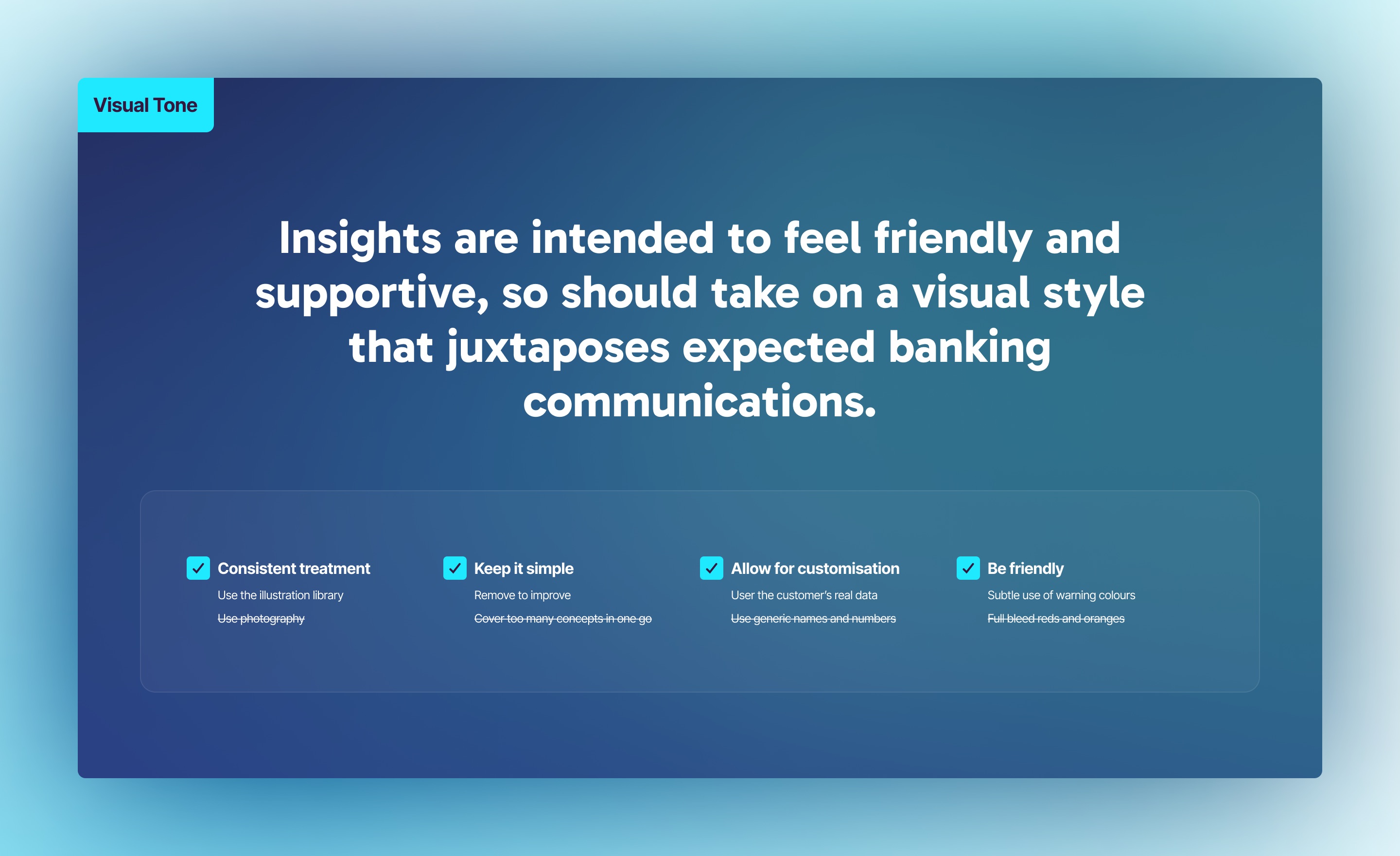

As well as that, you need to consider that these super personalised and targeted communications, which also suggest actions that a customer might want to do next (advice!?), are something that the bank has never even contemplated before. The legal and compliance risk levels were off the scale. But by treating these teams as partners rather than obstacles, they were included in the workshops where the Insights were created and, therefore, were included in the ownership of each idea from its inception.

Eighteen months after I joined the project, we finally went live in the Barclays app, with 1 Insight to 1% of the customer base. In the coming weeks, this scaled up gradually to 5, 10, 25 and 50%. The data we were getting back was fascinating, and despite a few teething issues with API and data processing systems, everything was holding together.

At the time of writing, the feature has delivered thousands of Insights to millions of customers, with more on the way.

What it's like to work with me.

Will has kept me honest throughout the project, providing guidance every step of the way which has resulted in a great experience for the customer.

Jack Maddock

Digital Product Manager, Barclays

Will is a great guy to work and is a brilliant designer who has been instrumental in the delivery of high profile features to the Barclays mobile app.

Nazim Hussain

Digital Product Manager, Barclays

Further recommendations and testimonials can be found on my Linkedin profile.

Projects

Contact

© 2024 Design by Will Rose Ltd.